Loss could top half a billion dollars.

Is the Model 3 ramp finally progressing?

Will this be a turning point for the stock?

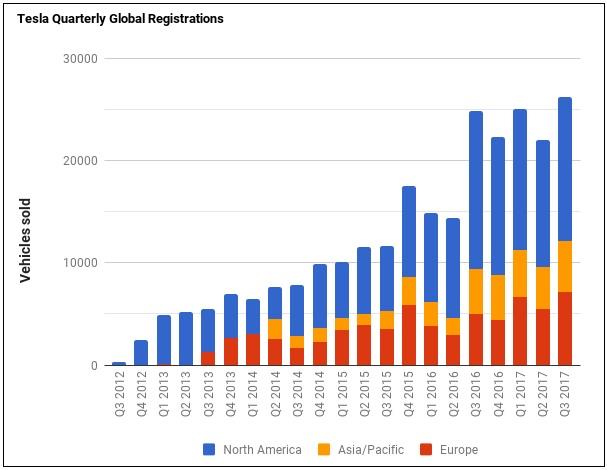

On Wednesday, we'll get one of the most anticipated earnings reports this quarter when Tesla (TSLA) details its Q3 results. While the company was able to set a new delivery record thanks to strong Model S and X sales, the Model 3 ramp got off to a much slower than expected start. With a lot on the line for investors and the company, I'm here today to provide a comprehensive preview of what to expect.

What we already know:

The company's first estimate at quarterly sales was 26,150 vehicles, a nearly 18% sequential rise partially helped by 220 Model 3 deliveries. In the second quarter, Tesla delivered just 22,026 vehicles, reported $2.79 billion in total revenues, and had a non-GAAP loss of $1.33 per share. The company lost $2.04 per share on a GAAP basis, and also recognized $100 million in ZEV credits that provided a huge benefit to GAAP margins.

(Source: Tesla Motors Club registration stats)

(Source: Tesla Motors Club registration stats)

We also know that during the period, Tesla borrowed another $1.8 billion in debt at a yearly coupon of 5.30%, and paid back more than $300 million of SolarCity's debts. Additionally, the US dollar was weaker vs. many key currencies, which could provide some benefits in the quarter. Tesla also made numerous product lineup changes, like removing 90 kWh battery pack models and changing prices on the vehicle configurations it did keep.

Revenues and gross margins:

If we take a look at current street estimates, analysts are looking for $2.93 billion in revenues for Q3. In my opinion, that seems a bit low, especially as one analyst has a forecast of just $2.7 billion. Considering the company delivered an additional 4,000 vehicles, there would have had to have been massive discounts for revenues to decline sequentially, even with the ZEV credit revenue recognized in Q2. Even if there was some discounting, the additional 4,000 vehicles will help automotive revenues and add to the global fleet for leasing revenues. Revenues in certain countries might also see a boost from the weaker dollar. I've got automotive revenues rising by almost $270 million sequentially.

Management also detailed some changes to the SolarCity model that should have resulted in a lower amount of installations. As a result, I'm expecting about a $27 million sequential decline in solar/energy revenues, and that number is partially offset by a rise in Tesla energy that is supposed to be ramping, although we've heard that story before. With a larger global fleet, a rise in service revenues and perhaps more sales of pre-owned vehicles should boost Tesla's other revenues, so I've got a $34 million increase there. In total, I'm expecting $3.065 billion for revenues in Q3, without any ZEV credit help.

After coming in at 25.0% in Q2, management guided to less than 20.0% non-GAAP automotive gross margins in Q3 due to initial Model 3 costs spread over low volumes. With production coming in more than 80% below forecast, that likely will hurt the situation even further, but the better than expected S/X sales should provide a tailwind. I'm projecting 19.89% here, while also looking for service/other margins to worsen and energy/solar margins to weaken a little due to less SolarCity revenues and more low-margin energy sales.

Overall, my forecast comes in with a total gross margin of 16.83%, which results in gross margin dollars of just under $516 million. That's a decline of about $150 million sequentially, which some may think is rather large, but don't forget I'm not counting on any ZEV credit sales. That was $100 million to Tesla's gross margin dollars figure in Q2, so a $50 million decline overall seems justifiable for the rest of the business.

Operating expenses and the bottom line:

While management says that operating expenses should be flat in the second half of the year, I don't see how that's possible given all the expansion needed for sales/service infrastructure, solar roof production ramp start, superchargers, etc. Throw in more R&D as Tesla continues to look to the future with more vehicles/services, and I think we'll see a tick up of $33 million sequentially. This puts the company at a $424 million operating loss, up from $241 million in Q2.

As we move down the income statement, interest expenses should rise thanks to the new debt deal. However, because I think we'll see a gain due to the revaluation of certain currency holdings, I'm actually projecting about a $10 million sequential improvement in interest/other items. I threw $15 million in for taxes, comparable to Q2's figure. My full model is shown below compared to Q1 and Q2 this year, with a discussion of the overall bottom line to follow. Some totals may not appear accurate due to rounding. Dollar values are in thousands, except for per share data.

Because of the changes to SolarCity, I see less of a loss to minority interests, but this is a complete guess, as this number may be Tesla's hardest to project. I also think that due to Model 3 milestone payments and other expenses ramping higher, we'll see $0.90 per share in stock-based compensation, compared to $0.71 in Q2. As a result, I'm expecting a non-GAAP loss of $2.21 per share, which is currently 8 cents better than the street, mainly because I think I'm expecting more stock-based compensation to be adjusted away than the street is.

Balance sheet and other items:

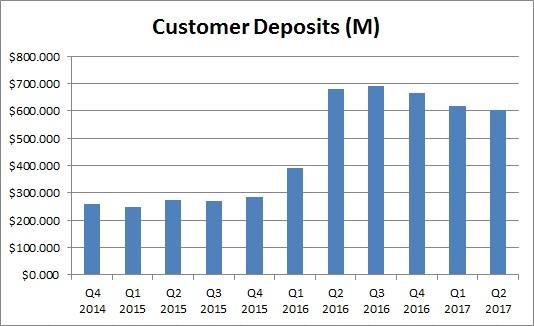

One of the first things investors will be looking at is the customer deposit balance, primarily trying to figure out if Model 3 reservations have increased. Well, it is possible that reservations could be flat even with a jump in total deposits, because Tesla reported a 1,300 vehicle in transit sequential increase from Q2 to Q3. As seen in the chart below, the company will be looking to end a three quarter decline in total deposits.

The street also will want to know how much cash was burned in this tremendous loss quarter. Capital expenditures were forecast to be $2 billion in the second half of 2017, but will that actually happen? If a rise in inventory related to the Model 3 or a decline in current liabilities leads to huge operating cash burn, Tesla could easily top Q2's burn of $1.16 billion. That will lead to more questions about when the next capital raise will be coming.

Forward guidance:

Obviously, the biggest question on this earnings report is the Model 3 production ramp. While Elon Musk was calling for Tesla to produce over 1,500 of these new vehicles in September alone, the company didn't even hit 300 for the entire third quarter. The timeline given below shows Tesla getting to 5,000 a week sometime in December, but there are very few people who believe that is possible at this point.

Source: seekingalpha

No comments:

Post a Comment